The Boston North Shore mortgage market probably contains a number of borrowers and prospective borrowers who would be considered affluent. As such, one would assume people who have lots of money, large assets and high net worth would almost automatically qualify them for a jumbo mortgage. If you assumed that, you’d be wrong at least some of the time. Some affluent borrowers still face considerable challenges when it comes to their credit scores. Let’s look at how low credit scores can affect even the rich in meeting the qualifications for a mortgage.

Boston North Shore Mortgage Market – Credit Affects Us All

The well-known credit reporting agency, Experian, recently released a survey showing that 40% of respondents who earn $100,000 or more still worry their credit score will adversely affect their ability to buy a home this year. In addition, 29% of those surveyed reported they were in the process of improving their credit scores to qualify for better terms on a home mortgage loan. The Experian survey was based on data collected back in February from 500 affluent borrowers or would-be borrowers who recently bought a home or were planning to buy within the next year.

While the average American may find it hard to believe that affluent borrowers – or anybody that earns $100,000 or more annually – could ever have credit problems, credit issues can affect anybody.

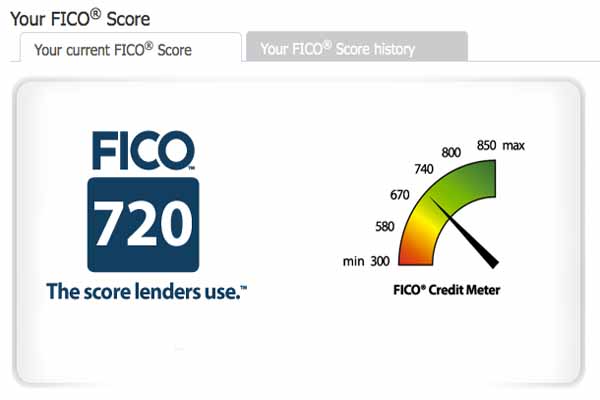

Boston North Shore mortgage market lenders say the minimum credit score is 720 to get the best jumbo rates and loan terms. Jumbo borrowers with credit scores below 680 are among those who begin facing serious qualification challenges. Some lending institutions may choose to qualify a borrower with a slightly lower credit score under two major conditions. First, the borrower must have income and assets that help offset the lower credit score and, second, if the lender is able to keep the jumbo loan in its in-house lending portfolio. Jumbo mortgages are loans in excess of $417,000 in most markets and $625,500 in select high-priced markets – the limits for the government-backed mortgages.

Ironically, wealthy borrowers often don’t even realize they have credit challenges. For example, many affluent borrowers assume their credit scores will remain high if they pay off high balances each month. However, credit reporting agencies also judge the credit management practices of borrowers to ensure they are able to handle credit accounts without becoming financially overwhelmed. In addition, despite their wealth some affluent people just don’t worry enough about their credit accounts. While it’s a great feeling to know you have credit balances that can probably be paid in full anytime, by not paying attention to payment due dates or late fees, any borrower – regardless of their income or net worth – can run into credit problems that may follow them forever.

An Experian credit specialist said, “It doesn’t matter how much money you have, it really is about how you manage your credit. For the best score, people should limit usage to less than 25% of each entire credit line.”

Another problem that often affects affluent borrowers is shared credit obligations. A spouse, for example, who has credit issues that remain unresolved – and unconfessed – can be a proverbial curve ball that can threaten approval of a loan application, not only in the Boston North Shore mortgage market, but nationwide as well. If unpaid bills create a problem, that problem can normally be solved by paying the bills in full and using a “rapid re-score” service. Mortgage lenders must request the re-score, which typically costs around $25 per account and can take place in 4-5 days.

New credit-reporting rules that go into affect this summer may also benefit affluent borrowers. The government-sponsored Federal National Mortgage Association (Fannie Mae) buys loans from mortgage lenders and sells them as mortgage-backed securities. They have recently added “trended credit-data reports” as part of their automated underwriting system, to be released into the Boston North Shore mortgage market June 25.

Existing credit reports only show the outstanding balances of each account. Therefore, on mortgages, car loans or credit cards the credit report shows what’s owed and whether the account holder has made payments on time or late. Under the new system, credit reports using trended data will give the lender more information. While the scoring method itself remains unchanged, the lender is provided with additional data such as the scheduled payment and actual payment amounts over time to better enable lenders to rate how borrowers use credit cards. For example, does the borrower pay the balances in full each month or does he make only the minimum payment?

While the new credit reports from providers TransUnion and Equifax will apply to government-backed mortgage loans, jumbo lenders will probably use them, too. Credit experts say this will give affluent borrowers with high net worths to show their ability to pay despite having high account balances.

You can find more articles pertaining to the Boston North Shore mortgage market in the Boston North Shore Mortgage Info section of our site below Boston North Shore Real Estate Categories in the column to your right.

We also post tips daily on Facebook and Twitter and would love for you to follow us there as well.